Essay

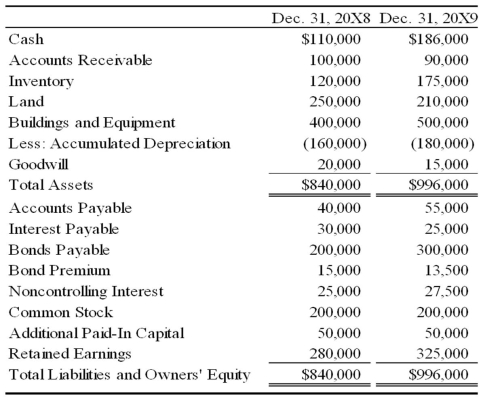

Boycott Company holds 75 percent ownership of Fred Corporation. The consolidated balance sheets as of December 31, 20X8, and December 31, 20X9, are as follows:

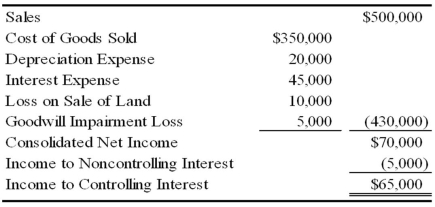

The 20X9 consolidated income statement contained the following amounts:

Boycott acquired its investment in Fred on January 1, 20X6, for $120,000. At that date, the fair value of the noncontrolling interest was $40,000, and Fred reported net assets of $130,000. A total of $20,000 of the differential was assigned to goodwill. The remainder of the differential was assigned to equipment with a remaining life of 10 years from the date of combination.

Boycott sold $100,000 of bonds on December 31, 20X9, to assist in generating additional funds. Fred reported net income of $20,000 for 20X9 and paid dividends of $10,000. Boycott reported 20X9 equity-method net income of $75,000 paid dividends of $20,000 for the year.

Required:

1) Prepare a worksheet to develop a consolidated statement of cash flows for 20X9 using the indirect method of computing cash flows from operations.

2) Prepare a consolidated statement of cash flows for 20X9.

Correct Answer:

Verified

1)  Worksheet entries:

Worksheet entries:

(a) Increase in c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(a) Increase in c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q15: On December 31, 20X7, Planet Corporation acquired

Q18: Which sections of the cash flow statement

Q19: Denver Corporation owns 25 percent of the

Q21: For the first quarter of 20X8, Vinyl

Q22: Electric Corporation holds 80 percent of Utility

Q23: Flyer Corporation holds 90 percent of Kite

Q24: On July 1, 20X8, Fair Logic Corporation

Q25: New Life Corporation has just finished preparing

Q56: Winter Corporation's consolidated cash flow statement for