Essay

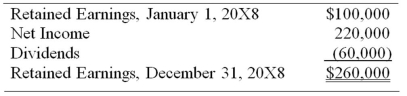

For the first quarter of 20X8, Vinyl Corporation reported sales of $150,000 and operating expenses of $100,000, and paid dividends of $20,000. Vinyl Company operates on a calendar-year basis. On April 1, 20X8, Signature Corporation acquired 80 percent of Vinyl's common stock for $320,000. At that date, the fair value of the noncontrolling interest was $80,000, and Vinyl had 20,000 shares of $5 par common stock outstanding, originally issued at $12 per share. The differential is related to goodwill. On December 31, 20X8, the management of Signature Corporation reviewed the amount attributed to goodwill as a result of its acquisition of Vinyl common stock and concluded that goodwill was not impaired. Vinyl's retained earnings statement for the full year 20X8 appears as follows:

Signature uses the fully adjusted equity method in accounting for this investment:

Required:

1) Prepare all entries that Signature would have recorded in accounting for its investment in Vinyl during 20X8.

2) Present all eliminating entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 20X8.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q18: Which sections of the cash flow statement

Q19: Denver Corporation owns 25 percent of the

Q20: Boycott Company holds 75 percent ownership of

Q22: Electric Corporation holds 80 percent of Utility

Q23: Flyer Corporation holds 90 percent of Kite

Q24: On July 1, 20X8, Fair Logic Corporation

Q25: New Life Corporation has just finished preparing

Q26: New Life Corporation has just finished preparing

Q56: Winter Corporation's consolidated cash flow statement for