Multiple Choice

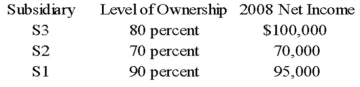

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:  Parent reported income from its separate operations of $200,000 for 20X8.

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, what amount of gain or loss on sale of land should be reported in the consolidated income statement for 20X8?

A) $60,000

B) $0

C) $75,000

D) $23,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Blue Company owns 70 percent of Black

Q29: Big Corporation receives management consulting services from

Q30: Note: This is a Kaplan CPA Review

Q31: ABC Corporation purchased land on January 1,

Q32: Blue Corporation holds 70 percent of Black

Q34: On January 1, 20X7, Servant Company purchased

Q35: On January 1, 20X9, Light Corporation sold

Q36: Sky Corporation owns 75 percent of Earth

Q38: Sky Corporation owns 75 percent of Earth

Q45: Parent Company owns 70% of Son Company's