Multiple Choice

Note: This is a Kaplan CPA Review Question

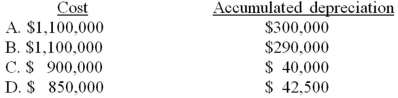

On January 1, 20X1, Poe Corp. sold a machine for $900,000 to Saxe Corp., its wholly-owned subsidiary. Poe paid $1,100,000 for this machine, which had accumulated depreciation of $250,000. Poe estimated a $100,000 salvage value and depreciated the machine on the straight-line method over 20 years, a policy which Saxe continued. In Poe's December 31, 20X1, consolidated balance sheet, this machine should be included in cost and accumulated depreciation as:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Fred Corporation owns 75 percent of Winner

Q26: Big Corporation receives management consulting services from

Q27: Big Corporation receives management consulting services from

Q29: Big Corporation receives management consulting services from

Q31: ABC Corporation purchased land on January 1,

Q32: Blue Corporation holds 70 percent of Black

Q33: Parent Corporation purchased land from S1 Corporation

Q34: On January 1, 20X7, Servant Company purchased

Q35: On January 1, 20X9, Light Corporation sold

Q45: Parent Company owns 70% of Son Company's