Multiple Choice

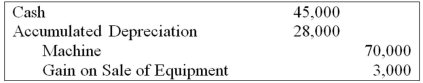

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:  Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information, consolidated net income for 20X9 will be:

A) $150,000.

B) $100,000.

C) $148,000.

D) $130,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Blue Company owns 70 percent of Black

Q38: Any intercompany gain or loss on a

Q38: Sky Corporation owns 75 percent of Earth

Q39: On January 1, 20X7, Servant Company purchased

Q40: Mortar Corporation acquired 80 percent of Granite

Q41: Mortar Corporation acquired 80 percent of Granite

Q42: Parent Corporation purchased land from S1 Corporation

Q43: Parent Corporation purchased land from S1 Corporation

Q44: Mortar Corporation acquired 80 percent of Granite

Q46: Blue Corporation holds 70 percent of Black