Multiple Choice

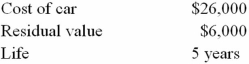

What is the depreciation expense for the first year straight-line method using the following?

A) $4,400

B) $5,200

C) $4,000

D) $6,000

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: In the straight-line method, book value never

Q19: Which method does not deduct residual value

Q21: Which one is not based on the

Q28: Depreciation expense is located on the:<br>A)Income statement<br>B)Balance

Q29: Using the declining-balance method, complete the table

Q38: Depreciation expense in the declining-balance method is

Q41: Depreciation expense is listed on the balance

Q47: MACRS does not use residual value; thus,

Q50: In the declining-balance method, we can depreciate

Q69: Depreciation is an exact science that requires