Essay

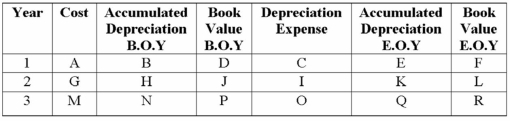

Using the declining-balance method, complete the table as shown (twice the straight-line rate):

Auto: $26,000

Estimated life: 10 years

Residual value: $600

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: A truck costs $9,200 with a residual

Q8: Land can be depreciated.

Q10: In the straight-line method, book value never

Q24: What is the depreciation expense for the

Q28: Depreciation expense is located on the:<br>A)Income statement<br>B)Balance

Q38: Depreciation expense in the declining-balance method is

Q50: In the declining-balance method, we can depreciate

Q68: A new truck costing $60,000 with a

Q81: Product obsolescence means the asset has been

Q85: MACRS is not used for tax purposes.