Multiple Choice

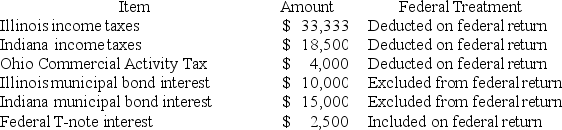

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $100,000. Calculate PWD's Illinois state tax base.

PWD's federal taxable income was $100,000. Calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $164,333

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The trade show rule allows businesses to

Q14: Most state tax laws adopt the federal

Q17: Carolina's Hats has the following sales, payroll,

Q18: Gordon operates the Tennis Pro Shop in

Q19: Mahre, Incorporated, a New York corporation, runs

Q22: Tennis Pro has the following sales, payroll,

Q23: Lefty provides demolition services in several southern

Q25: Wacky Wendy produces gourmet cheese in Wisconsin.

Q81: Which of the following isn't a criterion

Q89: A gross receipts tax is subject to