Multiple Choice

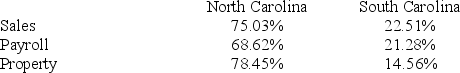

Carolina's Hats has the following sales, payroll, and property factors:  What is Carolina's Hats North and South Carolina apportionment factors if North Carolina uses an equally weighted three-factor formula and South Carolina uses a double-weighted sales factor formula? (Round your answers to two decimal places.)

What is Carolina's Hats North and South Carolina apportionment factors if North Carolina uses an equally weighted three-factor formula and South Carolina uses a double-weighted sales factor formula? (Round your answers to two decimal places.)

A) North Carolina 74.03 percent, and South Carolina 19.45 percent.

B) North Carolina 74.03 percent, and South Carolina 20.22 percent.

C) North Carolina 74.28 percent, and South Carolina 19.45 percent.

D) North Carolina 74.28 percent, and South Carolina 22.51 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Most state tax laws adopt the federal

Q18: Gordon operates the Tennis Pro Shop in

Q19: Mahre, Incorporated, a New York corporation, runs

Q20: PWD Incorporated is an Illinois corporation. It

Q22: Tennis Pro has the following sales, payroll,

Q26: The Wayfair decision reversed the Quill decision,

Q81: Which of the following isn't a criterion

Q89: A gross receipts tax is subject to

Q97: Separate-return states require each member of a

Q134: All states employ some combination of sales