Essay

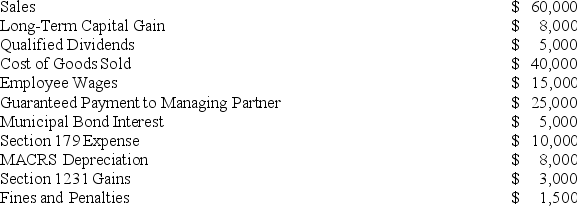

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

($28,000),...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A partnership with a C corporation partner

Q14: Sarah, Sue, and AS Inc.formed a partnership

Q36: Under proposed regulations issued by the Treasury

Q50: Hilary had an outside basis in LTL

Q57: Actual or deemed cash distributions in excess

Q79: Ruby's tax basis in her partnership interest

Q84: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q85: A partner's self-employment earnings (loss)may be affected

Q105: Tom is talking to his friend Bob,

Q118: In what order are the loss limitations