Essay

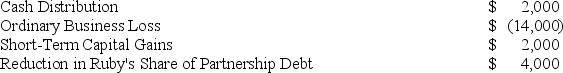

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

As shown in the table below, Ruby must f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A partnership with a C corporation partner

Q20: Frank and Bob are equal members in

Q50: Hilary had an outside basis in LTL

Q57: Actual or deemed cash distributions in excess

Q81: Illuminating Light Partnership had the following revenues,

Q84: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q85: A partner's self-employment earnings (loss)may be affected

Q105: Tom is talking to his friend Bob,

Q113: Any losses that exceed the tax basis

Q118: In what order are the loss limitations