Essay

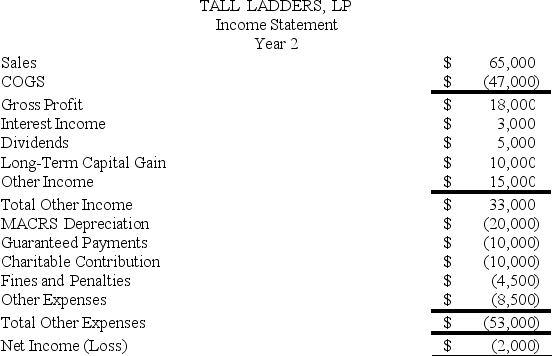

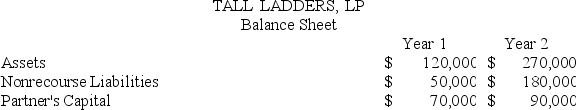

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

Tony's adjusted basis at the end of Year...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If a partner participates in partnership activities

Q19: The term "outside basis" refers to the

Q70: Which of the following would not be

Q73: Which of the following statements regarding the

Q96: Lincoln, Inc., Washington, Inc., and Adams, Inc.,

Q99: What type of debt is not included

Q104: Fred has a 45percent profits interest and

Q106: J&J, LLC, was in its third year

Q130: Which of the following statements regarding capital

Q131: Explain why partners must increase their tax