Essay

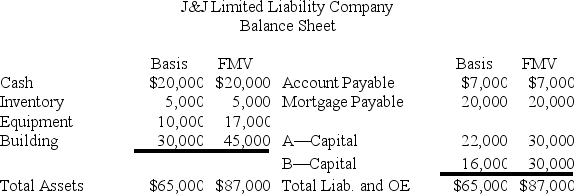

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

If member C received a one-third capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If a partner participates in partnership activities

Q19: The term "outside basis" refers to the

Q70: Which of the following would not be

Q73: Which of the following statements regarding the

Q96: Lincoln, Inc., Washington, Inc., and Adams, Inc.,

Q99: What type of debt is not included

Q103: At the end of Year 1, Tony

Q104: Fred has a 45percent profits interest and

Q130: Which of the following statements regarding capital

Q131: Explain why partners must increase their tax