Essay

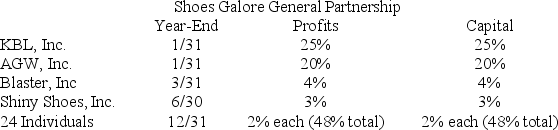

KBL,Inc.,AGW,Inc.,Blaster,Inc.,Shiny Shoes,Inc.,and a group of 24 individuals form Shoes Galore General Partnership on October 11,20X9.Now,Shoes Galore must adopt its required tax year-end.The partners' year-ends,profits interests,and capital interests are reflected in the table below.Given this information,what tax year-end must Shoes Galore use,and what rule requires this year-end?

Correct Answer:

Verified

Shoes Galore must adopt a 1/31 year-end ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If a partner participates in partnership activities

Q29: The least aggregate deferral test uses the

Q47: Ruby's tax basis in her partnership interest

Q71: What is the rationale for the specific

Q77: A partner's outside basis must first be

Q83: Under general circumstances, debt is allocated from

Q83: Jerry, a partner with 30percent capital and

Q107: Gerald received a one-third capital and profit

Q114: Partners must generally treat the value of

Q130: Which of the following statements regarding capital