Essay

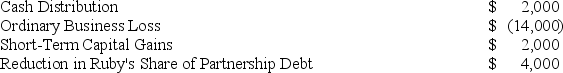

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000.The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

As shown in the table below,Ruby must fi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Which of the following entities is not

Q43: KBL,Inc.,AGW,Inc.,Blaster,Inc.,Shiny Shoes,Inc.,and a group of 24 individuals

Q49: Income earned by flow-through entities is usually

Q50: Illuminating Light Partnership had the following revenues,expenses,gains,losses,and

Q53: In what order should the tests to

Q71: What is the rationale for the specific

Q83: Under general circumstances, debt is allocated from

Q83: Jerry, a partner with 30percent capital and

Q107: Gerald received a one-third capital and profit

Q114: Partners must generally treat the value of