Essay

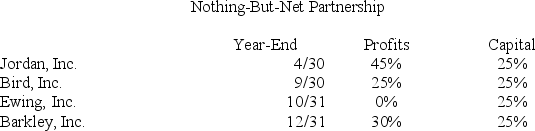

Jordan,Inc.,Bird,Inc.,Ewing,Inc.,and Barkley,Inc.,formed Nothing-But-Net Partnership on June 1st,20X9.Now,Nothing-But-Net must adopt its required tax year-end.The partners' year-ends,profits interests,and capital interests are reflected in the table below.Given this information,what tax year-end must Nothing-But-Net use,and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A partner's tax basis or at-risk amount

Q11: Which of the following statements regarding a

Q12: Clint noticed that the Schedule K-1 he

Q13: Tim, a real estate investor, Ken, a

Q41: In each of the independent scenarios below,

Q52: Styling Shoes, LLC, filed its 20X8 Form

Q68: If a taxpayer sells a passive activity

Q96: J&J,LLC,was in its third year of operations

Q97: The character of each separately stated item

Q123: Which person would generally be treated as