Essay

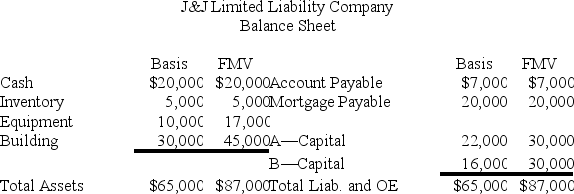

J&J,LLC,was in its third year of operations when J&J decided to expand the number of members from two,A and B,with equal profits and capital interests,to three members,A,B,and C.The third member,C,will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted,what are the tax consequences to members A,B,and C,and to J&J,when C receives her capital interest? If,instead,member C receives a one-third profits interest,what would be the tax consequences to members A,B,and C,and to J&J?

Correct Answer:

Verified

If member C received a one-third capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Which of the following statements regarding a

Q12: Clint noticed that the Schedule K-1 he

Q13: Tim, a real estate investor, Ken, a

Q24: Greg, a 40percent partner in GSS Partnership,

Q41: In each of the independent scenarios below,

Q52: Styling Shoes, LLC, filed its 20X8 Form

Q86: Which of the following items will affect

Q93: Jordan,Inc.,Bird,Inc.,Ewing,Inc.,and Barkley,Inc.,formed Nothing-But-Net Partnership on June 1<sup>st</sup>,20X9.Now,Nothing-But-Net

Q100: At the end of Year 1,Tony had

Q123: Which person would generally be treated as