Essay

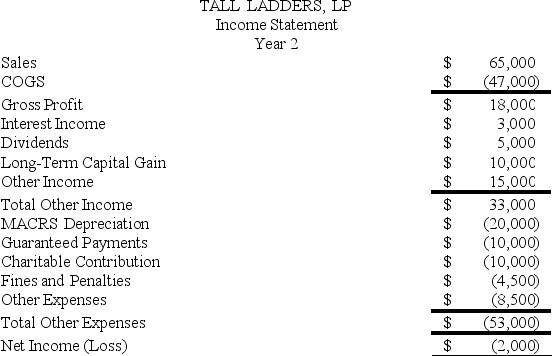

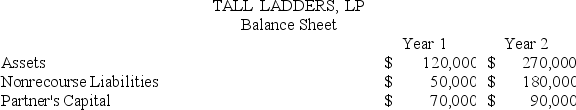

At the end of Year 1,Tony had a tax basis of $40,000 in Tall Ladders,Limited Partnership.Tony has a 20 percent profits interest in Tall Ladders.For Year 2,Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership.Given the following income statement and balance sheet from Tall Ladders,what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

Tony's adjusted basis at the end of Year...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Does adjusting a partner's basis for tax-exempt

Q11: Which of the following statements regarding a

Q12: Clint noticed that the Schedule K-1 he

Q24: Greg, a 40percent partner in GSS Partnership,

Q40: Partnership tax rules incorporate both the entity

Q86: Which of the following items will affect

Q96: J&J,LLC,was in its third year of operations

Q96: What is the difference between a partner's

Q106: Partners adjust their outside basis by adding

Q123: Which person would generally be treated as