Essay

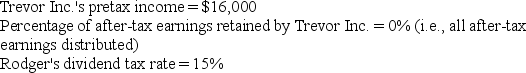

Rodger owns 100 percent of the shares in Trevor Inc.,a C corporation.Assume the following for the current year:

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which legal entity is generally best suited

Q11: The excess loss limitations apply to owners

Q12: Business income allocations from an S corporation

Q13: Sole proprietorships are not treated as legal

Q15: S corporation shareholders are legally responsible for

Q22: Unincorporated entities with only one individual owner

Q64: Which of the following legal entities files

Q78: If individual taxpayers are the shareholders of

Q84: An unincorporated entity with more than one

Q86: S corporations have more restrictive ownership requirements