Essay

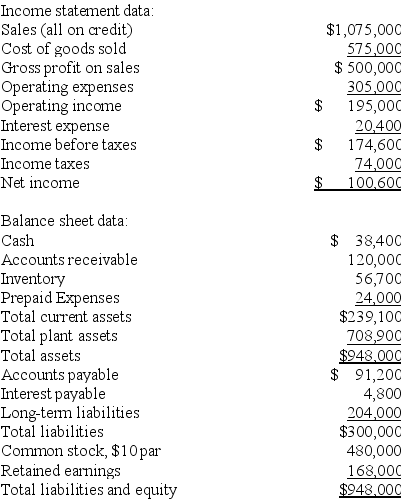

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a)Current ratio.

(b)Accounts receivable turnover.(Assume the prior year's accounts receivable balance was $100,000.)

(c)Days' sales uncollected.

(d)Inventory turnover.(Assume the prior year's inventory was $50,200.)

(e)Times interest earned ratio.

(f)Return on common stockholders' equity.(Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g)Earnings per share (assuming the corporation has a simple capital structure,with only common stock outstanding).

(h)Price earnings ratio.(Assume the company's stock is selling for $26 per share.)

(i)Divided yield ratio.(Assume that the company paid $1.25 per share in cash dividends.)

Correct Answer:

Verified

(a)  Current ratio = $239,100/$96,000 = ...

Current ratio = $239,100/$96,000 = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: The evaluation of company performance and financial

Q49: Industry standards for financial statement analysis:<br>A)Are based

Q127: The comparison of a company's financial condition

Q129: Internal users of financial information:<br>A) Are not

Q139: The current ratio and acid-test ratio are

Q142: Current assets divided by current liabilities is

Q160: The measurement of key relations among financial

Q213: The return on total assets can be

Q226: A corporation reports the following year-end

Q233: Stories Company reported Cost of goods sold