Essay

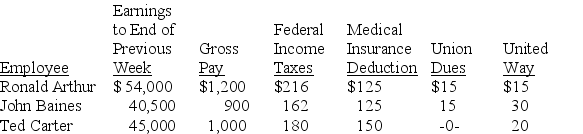

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: If the times interest earned ratio:<br>A)Increases,then risk

Q60: Hollow Company provides you with following information

Q62: A company sold $12,000 worth of bicycles

Q65: The amount of federal income taxes withheld

Q67: An employee earns $5,500 per month working

Q78: Describe contingent liabilities and how to account

Q114: All of the following statements regarding uncertainty

Q134: In the accounting records of a defendant,

Q138: A corporation has a $40,000 credit balance

Q145: A company's income before interest expense and