Essay

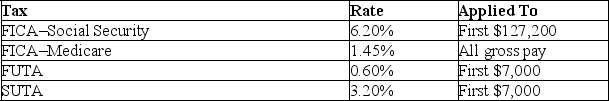

Hollow Company provides you with following information for two of its employees.The company is subject to the following taxes.

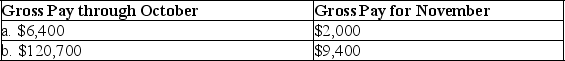

Compute amounts for each of these four taxes as applied to each employee's gross earnings for November.

Compute amounts for each of these four taxes as applied to each employee's gross earnings for November.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q52: If the times interest earned ratio:<br>A)Increases,then risk

Q56: Portia Grant is an employee who is

Q62: A company sold $12,000 worth of bicycles

Q65: The payroll records of a company provided

Q69: All of the following are true of

Q78: Describe contingent liabilities and how to account

Q99: The deferred income tax liability:<br>A)Arises when income

Q122: Accrued vacation benefits are a form of

Q138: A corporation has a $40,000 credit balance

Q209: The more _allowances an employee claims,