Essay

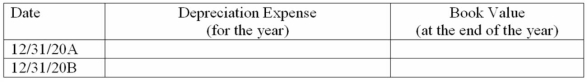

Sutter Company purchased a machine on January 1, 20A, for $16,000. The machine has an estimated useful life of 5 years and a $1,000 residual value. It is now December 31, 20B, and Sutter is in the process of preparing financial statements. Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: If the proceeds from the sale of

Q87: Research costs are an example of intangible

Q95: Because of depreciation, the net carrying amount

Q96: The depreciable amount is:<br>A) the original cost

Q97: Carpenter Corporation purchased a mineral deposit, making

Q98: Yell Company made a lump sum purchase

Q101: Which of the following costs would be

Q102: Under what conditions would a company most

Q139: When an asset is retired, a gain

Q148: Depreciation and depletion conceptually are different because