Essay

Yell Company made a lump sum purchase of an office building, including the land and some fixture

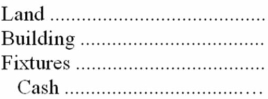

for cash of $160,000. The tax assessments for the past year reflected the following: Land, $22,500; Building, $58,500; and Fixtures, $9,000. Complete the following entry for the acquisition:

Correct Answer:

Verified

Correct Answer:

Verified

Q66: If the proceeds from the sale of

Q93: Operational assets do not include which of

Q95: Because of depreciation, the net carrying amount

Q96: The depreciable amount is:<br>A) the original cost

Q97: Carpenter Corporation purchased a mineral deposit, making

Q99: Sutter Company purchased a machine on January

Q101: Which of the following costs would be

Q102: Under what conditions would a company most

Q139: When an asset is retired, a gain

Q148: Depreciation and depletion conceptually are different because