Essay

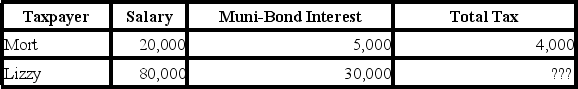

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Correct Answer:

Verified

Mort's average tax rate is 20 percent.

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Curtis invests $250,000 in a city of

Q18: Manny, a single taxpayer, earns $65,000 per

Q31: A sales tax is a common example

Q63: The state of Georgia recently increased its

Q65: A use tax is typically imposed by

Q78: Which of the following is true?<br>A)A regressive

Q100: Oswald is beginning his first tax course

Q105: Consider the following tax rate structure. Is

Q124: One key characteristic of a tax is

Q125: Earmarked taxes are:<br>A)taxes assessed only on certain