Essay

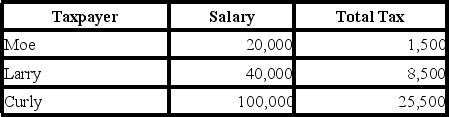

Consider the following tax rate structure. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Correct Answer:

Verified

We cannot evaluate whether the tax rate ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

We cannot evaluate whether the tax rate ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q15: Jackson has the choice to invest in

Q18: Manny, a single taxpayer, earns $65,000 per

Q34: Manny, a single taxpayer, earns $65,000 per

Q63: The state of Georgia recently increased its

Q65: A use tax is typically imposed by

Q78: Which of the following is true?<br>A)A regressive

Q100: Oswald is beginning his first tax course

Q102: Given the following tax structure, what is

Q102: The effective tax rate, in general, provides

Q125: Earmarked taxes are:<br>A)taxes assessed only on certain