Multiple Choice

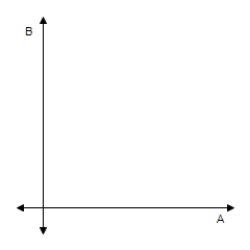

An investor has $450,000 to invest in two types of investments.Type A pays 6% annually and type B pays 7% annually.To have a well-balanced portfolio, the investor imposes the following conditions.At least one-third of the total portfolio is to be allocated to type A investments and at least one-third of the portfolio is to be allocated to type B investments.What is the optimal amount that should be invested in each investment?

A) $160,000 in type A (6%) , $290,000 in type B (7%)

B) $0 in type A (6%) , $450,000 in type B (7%)

C) $450,000 in type A (6%) , $0 in type B (7%)

D) $300,000 in type A (6%) , $150,000 in type B (7%)

E) $150,000 in type A (6%) , $300,000 in type B (7%)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Write the partial fraction decomposition of

Q3: Use any method to solve the

Q4: Use back-substitution to solve the system

Q5: Solve the system by the method

Q6: Determine whether the ordered triple is

Q7: Use back-substitution to solve the system

Q8: <br>For the rational expression

Q10: Find the maximum value of the objective

Q17: A chemist needs 10 liters of a

Q47: Find the equilibrium point (x,p)of the demand