Essay

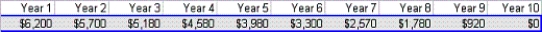

Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. Now assume that the project has an abandonment option. At the end of each year you can abandon the project for the values given below:  For example, suppose that year 1 cash flow is $400. Then at the end of year 1, you expect cash flow for each remaining year to be $400. This has an NPV of less than $6200, so you should abandon the project and collect $6200 at the end of year 1. Estimate the mean and standard deviation of the project with the abandonment option. How much would you pay for the abandonment option? (Hint: You can abandon a project at most once. Thus in year 5, for example, you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned. Also, once you abandon the project, the actual cash flows for future years will 0. So the future cash flows after abandonment should disappear.)

For example, suppose that year 1 cash flow is $400. Then at the end of year 1, you expect cash flow for each remaining year to be $400. This has an NPV of less than $6200, so you should abandon the project and collect $6200 at the end of year 1. Estimate the mean and standard deviation of the project with the abandonment option. How much would you pay for the abandonment option? (Hint: You can abandon a project at most once. Thus in year 5, for example, you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned. Also, once you abandon the project, the actual cash flows for future years will 0. So the future cash flows after abandonment should disappear.)

Correct Answer:

Verified

The mean and standard deviati...

The mean and standard deviati...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: In a bidding model,once we have a

Q12: A key objective in cash flow models

Q13: An executive has been offered a compensation

Q14: (A) Assuming we are risk neutral, use

Q16: You would like to develop a simulation

Q18: Which of the following is typically not

Q19: Assume that one of the bidders bids

Q20: Using the information from the pro forma

Q21: Simulate Amanda's portfolio over the next 30

Q27: What is the probability that your portfolio's