Multiple Choice

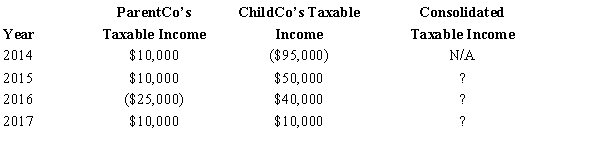

ParentCo purchased all of the stock of ChildCo on January 2, 2015, and the two companies filed consolidated returns for 2015 and thereafter. Both entities were incorporated in 2014. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2014 losses used by the group in 2015-2017?

Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2014 losses used by the group in 2015-2017?

A) $100,000

B) $95,000

C) $75,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q1: How are the members of a Federal

Q5: Outline the major advantages and disadvantages of

Q42: Describe the general computational method used by

Q76: Consolidated group members each must use the

Q81: When the net accumulated taxable losses of

Q83: Match each of the following items with

Q93: When a consolidated NOL is generated, each

Q121: Members of a parent-subsidiary controlled group must

Q130: The Nannerl consolidated group reported the following

Q152: The starting point in computing consolidated taxable