Multiple Choice

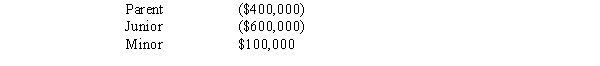

The Nannerl consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Junior.

A) $500,000.

B) $540,000.

C) $600,000.

D) $0. All NOLs of a consolidated group are apportioned to the parent.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Describe the general computational method used by

Q81: When the net accumulated taxable losses of

Q83: Match each of the following items with

Q107: Match each of the following items with

Q125: ParentCo purchased all of the stock of

Q131: In computing consolidated E & P, a

Q131: If subsidiary stock is redeemed or sold

Q132: Campbell Corporation left the Crane consolidated tax

Q133: ParentCo and SubCo had the following items

Q152: The starting point in computing consolidated taxable