Multiple Choice

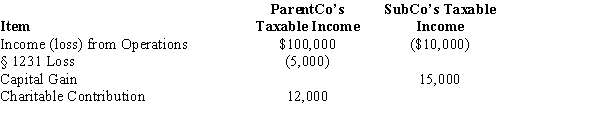

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000

B) $88,000

C) $90,000

D) $90,500

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q43: Match each of the following items with

Q83: Match each of the following items with

Q107: Match each of the following items with

Q130: The Nannerl consolidated group reported the following

Q131: In computing consolidated E & P, a

Q131: If subsidiary stock is redeemed or sold

Q132: Campbell Corporation left the Crane consolidated tax

Q149: With the filing of its first consolidated

Q152: The starting point in computing consolidated taxable

Q154: Each of the members of a Federal