Multiple Choice

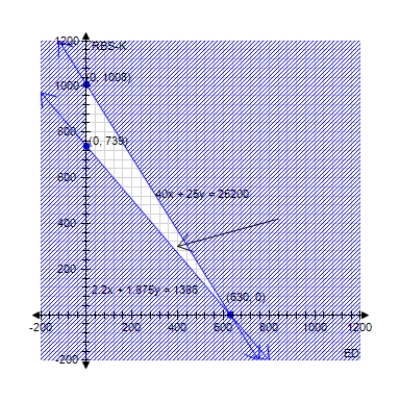

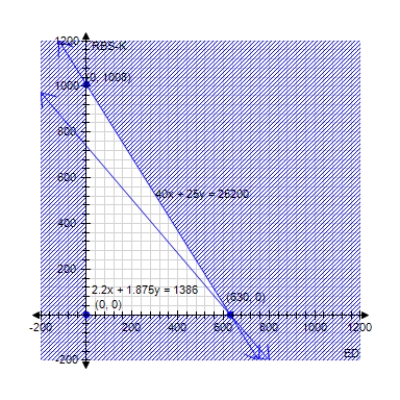

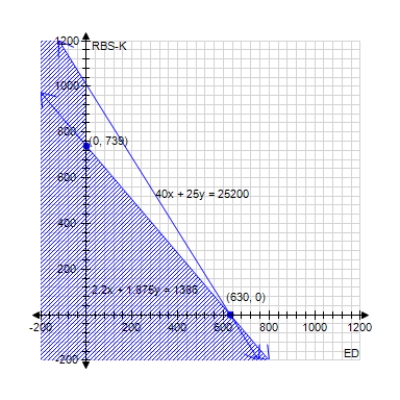

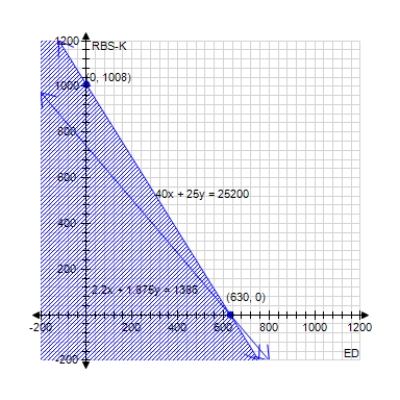

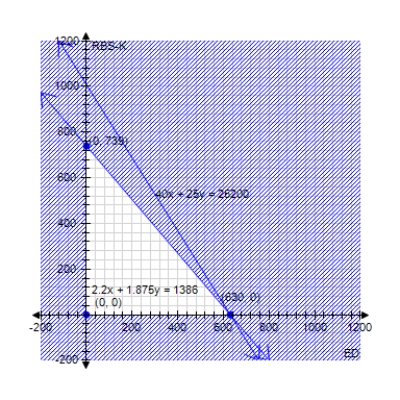

Your friend's portfolio manager has suggested two high-yielding stocks: Consolidated Edison (ED) and Royal Bank of Scotland (RBS-K) . ED shares cost $40 and yield 5.5% in dividends. RBS-K shares cost $25 and yield 7.5% in dividends. You have up to $25,200 to invest, and would like to earn at least $1,386 in dividends. Draw the feasible region that shows how many shares in each company you can buy. Find the corner points of the region. (Round each coordinate to the nearest whole number.)

Let the number of shares in ED be x, and the number of shares in RBS-K be y.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Select the correct graph of the

Q42: Maximize <span class="ql-formula" data-value="p =

Q43: Federal Rent-a-Car is putting together a new

Q44: Your small farm encompasses 100 acres, and

Q45: The Megabuck Hospital Corp. is to build

Q47: Oz makes lion food out of giraffe

Q48: Graph the solution set to the

Q49: Minimize<br> <span class="ql-formula" data-value="c =

Q50: The Enormous State University's Business School is

Q51: Solve the games with the given