Multiple Choice

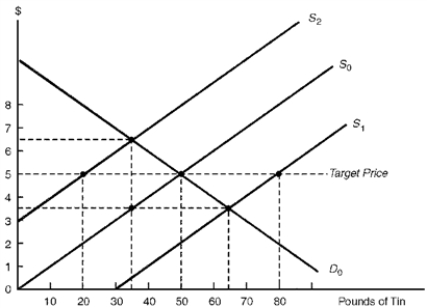

The diagram below illustrates the international tin market. Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2. Defending the Target Price in Face of Changing Supply Conditions

?

-Consider Figure 7.2.Suppose the supply of tin decreases from S0 to S2.Under a buffer stock system, the buffer-stock manager could maintain the target price by

A) purchasing 15 pounds of tin.

B) purchasing 30 pounds of tin.

C) selling 15 pounds of tin.

D) selling 30 pounds of tin.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: Once a cartel establishes its profit-maximizing price,<br>A)

Q116: Assuming identical cost and demand curves, OPEC

Q117: A multilateral contract stipulates the maximum price

Q118: To prevent the market price of tin

Q119: The recent technological advances in oil production,

Q121: Which of the following could partially explain

Q122: Import substitution is an example of<br>A) an

Q123: Outward-oriented growth strategies emphasize<br>A) the allocation of

Q124: According to the Generalized System of Preferences

Q125: Figure 7.3. World Oil Market <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7110/.jpg"