Short Answer

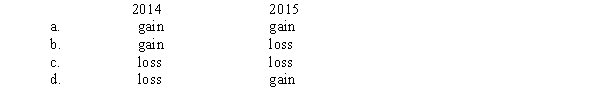

During 2014, a U.S.company purchased inventory from a foreign supplier.The transaction was denominated in the local currency of the seller.The direct exchange rate increased from the date of the transaction to the balance sheet date.The exchange rate decreased from the balance sheet date to the settlement date in 2015.For the years 2014 and 2015, transaction gains or losses should be recognized as:

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On April 1, 2014, Manatee Company entered

Q5: A transaction loss would result from:<br>A) an

Q6: Greco, Inc.a U.S.corporation, bought machine parts from

Q6: The discount or premium on a forward

Q8: On November 1, 2014, American Company sold

Q9: Kettle Company purchased equipment for 375,000 British

Q9: A transaction gain is recorded when there

Q20: An indirect exchange rate quotation is one

Q23: A transaction gain or loss on a

Q25: A discount or premium on a forward