Short Answer

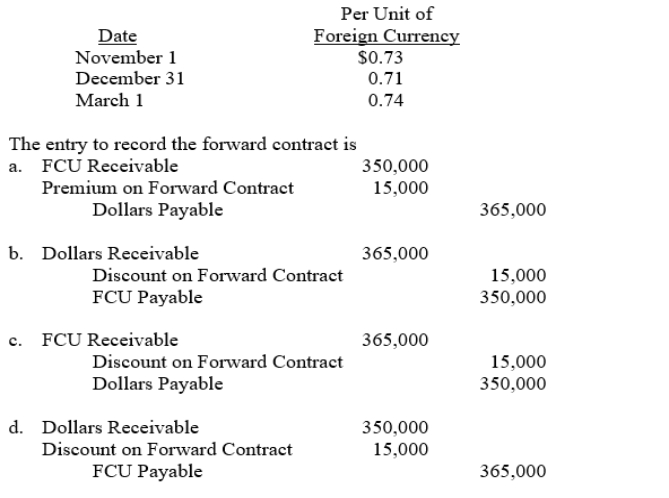

On November 1, 2014, American Company sold inventory to a foreign customer.The account will be settled on March 1 with the receipt of $500,000 foreign currency units (FCU).On November 1, American also entered into a forward contract to hedge the exposed asset.The forward rate is $0.70 per unit of foreign currency.American has a December 31 fiscal year-end.Spot rates on relevant dates were:

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A transaction loss would result from:<br>A) an

Q6: Greco, Inc.a U.S.corporation, bought machine parts from

Q6: The discount or premium on a forward

Q7: During 2014, a U.S.company purchased inventory from

Q8: From the viewpoint of a U.S. company,

Q9: Kettle Company purchased equipment for 375,000 British

Q9: A transaction gain is recorded when there

Q20: An indirect exchange rate quotation is one

Q23: A transaction gain or loss on a

Q25: A discount or premium on a forward