Essay

Pine Company owns an 80% interest in Salad Company and a 90% interest in Tuna Company.During 2013 and 2014, intercompany sales of merchandise were made by all three companies.Total sales amounted to $2,400,000 in 2013, and $2,700,000 in 2014.The companies sold their merchandise at the following percentages above cost.

Pine 15%

Salad 20%

Tuna 25%

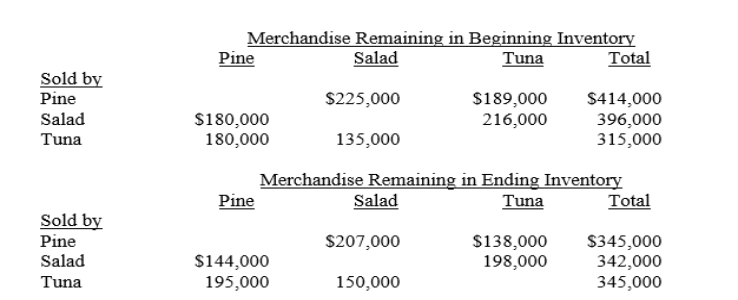

The amount of merchandise remaining in the 2014 beginning and ending inventories of the companies from these intercompany sales is shown below.

Reported net incomes (from independent operations including sales to affiliates) of Pine, Salad, and Tuna for 2014 were $3,600,000, $1,500,000, and $2,400,000, respectively.

Required:

A.Calculate the amount noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2014.

B.Calculate the controlling interest in consolidated net income for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Failure to eliminate intercompany sales would result

Q31: Use the following information for Questions 17

Q32: Determination of the noncontrolling interest in consolidated

Q34: Pruitt Company owns 80% of Stoney Company's

Q34: P Company sold merchandise costing $240,000 to

Q35: The noncontrolling interest in consolidated income when

Q36: Why are adjustments made to the calculation

Q37: A 90% owned subsidiary sold merchandise at

Q38: Puma Company owns 80% of the common

Q39: Pinta Company owns 90% of the common