Essay

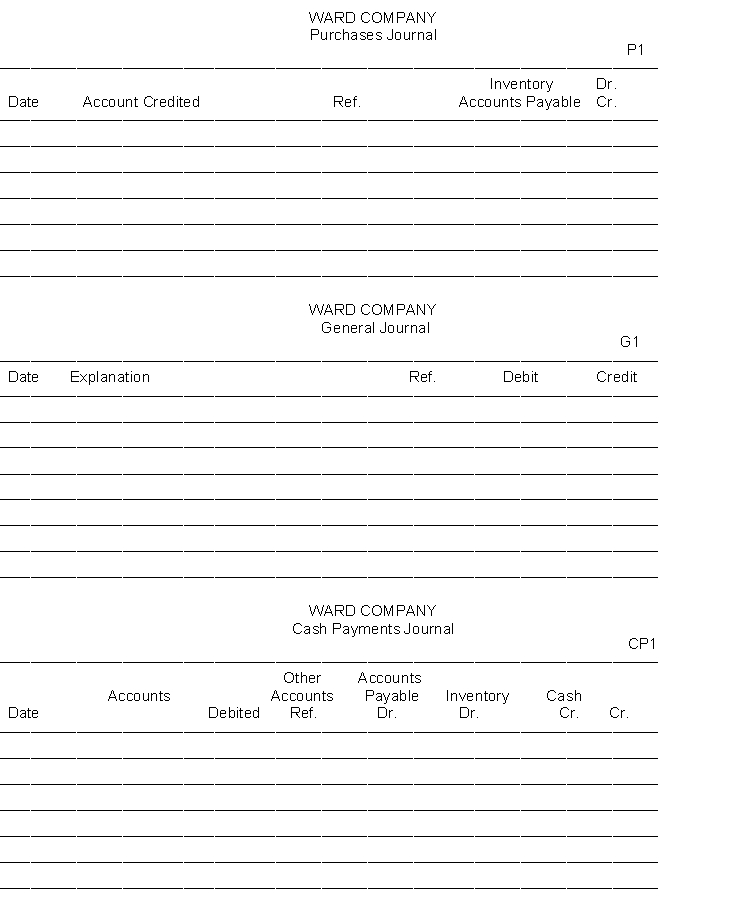

Ward Company uses a single-column purchases journal, a cash payments journal, and a general journal to record transactions with its suppliers and others. Record the following transactions in the appropriate journals.

Transactions

Oct. 5 Purchased merchandise on account for $15,000 from Groton Company. Terms: 2/10, n/30; FOB shipping point.

Oct. 6 Paid $7,200 to Federated Insurance Company for a two-year fire insurance policy.

Oct. 8 Purchased supplies on account for $700 from Flynn Supply Company. Terms: 2/10, n/30.

Oct. 11 Purchased merchandise on account for $14,000 from Buehler Corporation. Terms: 2/10, n/30; FOB shipping point.

Oct. 13 Issued a debit memorandum for $3,000 to Buehler Corporation for merchandise purchased on October 11 and returned because of damage.

Oct. 15 Paid Groton Company for merchandise purchased on October 5, less discount.

Oct. 16 Purchased merchandise for $8,000 cash from Clifford Company.

Oct. 21 Paid Buehler Corporation for merchandise purchased on October 11, less merchandise returned on October 13, less discount.

Oct. 25 Purchased merchandise on account for $22,000 from Dooley Company. Terms: 2/10, n/30; FOB shipping point.

Oct. 31 Purchased office equipment for $30,000 cash from Paten Office Supply Company.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A $10000 6% 5-year note payable that

Q16: Repair costs incurred in honoring warranty contracts

Q19: Luis Rodriguez wants to buy a car

Q30: Interest is the difference between the amount

Q40: The future value of 1 factor will

Q83: Cross-footing a cash receipts journal means<br>A) the

Q101: A debit column for Sales Returns and

Q116: If a transaction cannot be recorded in

Q200: Gates Company maintains four special journals and

Q206: Warren Company's payroll for the week ending