Essay

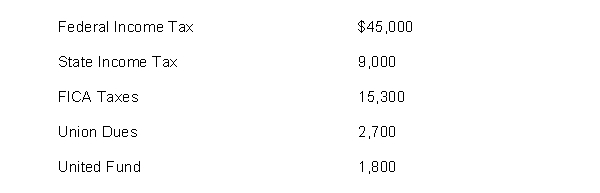

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and the employer's payroll tax expense on the payroll for January 15.

Correct Answer:

Verified

(To record employer...

(To record employer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A $10000 6% 5-year note payable that

Q16: Repair costs incurred in honoring warranty contracts

Q19: Luis Rodriguez wants to buy a car

Q30: Interest is the difference between the amount

Q40: The future value of 1 factor will

Q101: A debit column for Sales Returns and

Q101: Changes in pay rates during employment should

Q203: Ward Company uses a single-column purchases journal,

Q209: Match the statements below with the appropriate

Q214: Posting a sales journal to the accounts