Multiple Choice

Use the following information for questions 57 through 59.

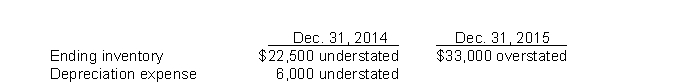

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2015 net income?

A) Net income understated by $43,500.

B) Net income overstated by $22,500.

C) Net income overstated by $39,000.

D) Net income overstated by $45,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: On January 1, 2012, Hess Co. purchased

Q94: Ridge, Inc. follows IFRS for its external

Q95: Matching accounting changes to situations.The four types

Q96: Which of the following describes a change

Q97: Quigley Co. bought a machine on January

Q99: Which of the following should be reported

Q100: Use the following information for questions 53

Q101: On January 1, 2012, Lake Co. purchased

Q102: Use the following information for questions 53

Q103: On December 31, 2015, special insurance costs,