Short Answer

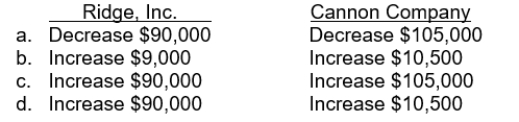

Ridge, Inc. follows IFRS for its external financial reporting, and Cannon Company follows U.S. GAAP for its external financial reporting. During 2015, both companies changed depreciation methods, from double-declining balance to straight-line. Compared to double-declining balance, for Ridge, Inc. the change resulted in a decrease in reported depreciation expense of $90,000, and for Cannon Company the change resulted in a reported decrease in depreciation expense of $105,000. The remaining useful lives of the assets impacted by the change in depreciation method is 10 years for both companies. How would this change impact the net income reported by Ridge, Inc. and Cannon Company for the year ended December 31, 2015?

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Under IFRS, errors in financial statements are

Q90: In the process of conversion from the

Q91: Stone Company changed its method of pricing

Q92: Is the following exception applicable to IFRS

Q93: On January 1, 2012, Hess Co. purchased

Q95: Matching accounting changes to situations.The four types

Q96: Which of the following describes a change

Q97: Quigley Co. bought a machine on January

Q98: Use the following information for questions 57

Q99: Which of the following should be reported