Multiple Choice

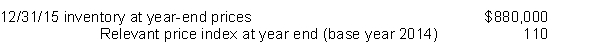

Farr Co. adopted the dollar-value LIFO inventory method on December 31, 2014. Farr's entire inventory constitutes a single pool. On December 31, 2014, the inventory was $640,000 under the dollar-value LIFO method. Inventory data for 2015 are as follows:  Using dollar value LIFO, Farr's inventory at December 31, 2015 is

Using dollar value LIFO, Farr's inventory at December 31, 2015 is

A) $704,000.

B) $816,000.

C) $800,000.

D) $880,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: Costs which are inventoriable include all of

Q87: In a period of falling prices, which

Q88: Elkins Corporation uses the perpetual inventory method.

Q89: Use the following information for questions 103

Q90: Black Corporation uses the FIFO method for

Q92: Use the following information to answer questions

Q93: Purchase Discounts Lost is a financial expense

Q94: Use the following information for 121 and

Q95: Opera Corp. uses dollar-value LIFO method of

Q96: When using the periodic inventory system, which