Multiple Choice

Use the following information to answer questions 6-8.

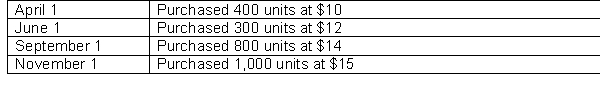

Barton Company uses a periodic inventory system. On January 1, 2014, Barton Company had 1,200 units of inventory on hand at a cost of $8 per unit. During 2014, Barton made the following inventory purchases.  Assume Barton Company sold 2,300 units of inventory during 2014.

Assume Barton Company sold 2,300 units of inventory during 2014.

-If you assume that Barton follows IFRS and uses the Average-cost method, what is the ending inventory and cost of goods sold, respectively?

A) Ending inventory = $11,600; Cost of Goods Sold = $31,800

B) Ending inventory = $16,520; Cost of Goods Sold = $26,880

C) Ending inventory = $16,422; Cost of Goods Sold = $26,978

D) Ending inventory = $20,600; Cost of Goods Sold = $22,800

Correct Answer:

Verified

Correct Answer:

Verified

Q87: In a period of falling prices, which

Q88: Elkins Corporation uses the perpetual inventory method.

Q89: Use the following information for questions 103

Q90: Black Corporation uses the FIFO method for

Q91: Farr Co. adopted the dollar-value LIFO inventory

Q93: Purchase Discounts Lost is a financial expense

Q94: Use the following information for 121 and

Q95: Opera Corp. uses dollar-value LIFO method of

Q96: When using the periodic inventory system, which

Q97: Risers Inc. reported total assets of $3,200,000