Essay

Calculation of unknown rent and interest.

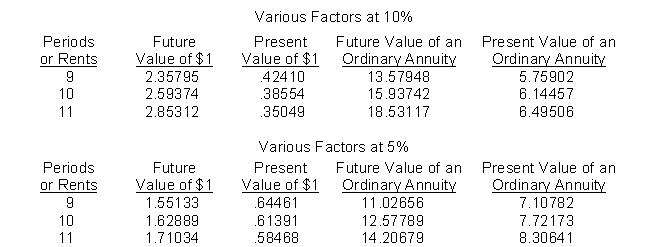

Pine Leasing Company purchased specialized equipment from Wayne Company on December 31, 2013 for $800,000. On the same date, it leased this equipment to Sears Company for 5 years, the useful life of the equipment. The lease payments begin January 1, 2014 and are made every 6 months until July 1, 2018. Pine Leasing wants to earn 10% annually on its investment.

Instructions

(a) Calculate the amount of each rent.

(b) How much interest revenue will Pine earn in 2014?

Correct Answer:

Verified

(a) Calculation of rent: 7.721...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Compute the annual rent. (Tables needed.)<br>Crone Co.

Q2: Altman Company will invest $700,000 today. The

Q3: Compound interest uses the accumulated balance at

Q4: Stech Co. is issuing $7.5 million 12%

Q6: The expected cash flow approach uses a

Q7: In the time diagram below, which concept

Q8: Items 69 through 72 apply to the

Q9: Reegan Company owns a trade name that

Q10: An amount is deposited for eight years

Q11: Lucy and Fred want to begin saving