Multiple Choice

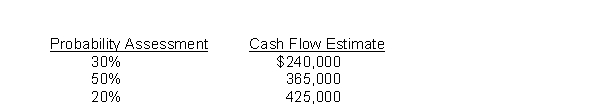

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company. The trade name has a book value of $1,800,000, but according to IFRS, it is assessed for impairment on an annual basis. To perform this impairment test, Reegan must estimate the fair value of the trade name. It has developed the following cash flow estimates related to the trade name based on internal information. Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years. The trade name is assumed to have no residual value after the 7 years. (Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

A) $1,800,000

B) $ 339,500

C) $1,030,000

D) $1,895,218

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Stech Co. is issuing $7.5 million 12%

Q5: Calculation of unknown rent and interest.<br>Pine Leasing

Q6: The expected cash flow approach uses a

Q7: In the time diagram below, which concept

Q8: Items 69 through 72 apply to the

Q10: An amount is deposited for eight years

Q11: Lucy and Fred want to begin saving

Q12: If Jethro wanted to save a set

Q13: Hiller Corporation makes an investment today (January

Q14: On January 1, 2014, Gore Co. sold