Short Answer

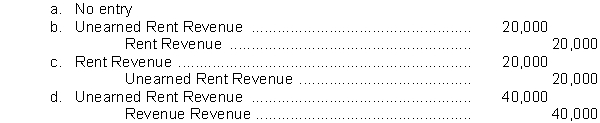

Murphy Company sublet a portion of its warehouse for five years at an annual rental of $60,000, beginning on May 1, 2014. The tenant, Sheri Charter, paid one year's rent in advance, which Murphy recorded as a credit to Unearned Rent Revenue. Murphy reports on a calendar-year basis. The adjustment on December 31, 2014 for Murphy should be

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Cash to accrual accounting.The following information is

Q57: Maso Company recorded journal entries for the

Q58: Which of the following is an example

Q59: Debit always means<br>A) the right side of

Q60: Icon International, a software company, incorporated on

Q62: One purpose of a trial balance is

Q63: At the time a company prepays a

Q64: Factors that shape an accounting information system

Q65: A reversing entry should never be made

Q66: A company receives interest on a $70,000,