Short Answer

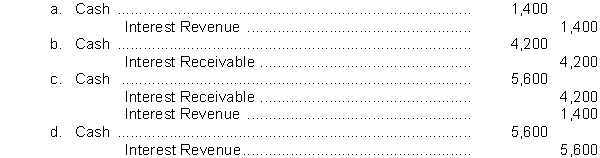

A company receives interest on a $70,000, 8%, 5-year note receivable each April 1. At December 31, 2014, the following adjusting entry was made to accrue interest receivable:

Interest Receivable 4,200

Interest Revenue 4,200

Assuming that the company does use reversing entries, what entry should be made on April 1, 2015 when the annual interest payment is received?

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Murphy Company sublet a portion of its

Q62: One purpose of a trial balance is

Q63: At the time a company prepays a

Q64: Factors that shape an accounting information system

Q65: A reversing entry should never be made

Q67: Definitions.Provide clear, concise answers for the following.<br>1.

Q68: All liability accounts and stockholders' equity accounts

Q69: Unearned revenue on the books of one

Q70: Gregg Corp. reported revenue of $1,450,000 in

Q71: Included in Allen Corp.'s balance sheet at