Multiple Choice

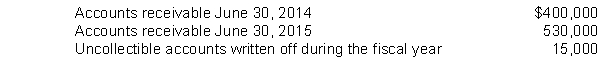

Gregg Corp. reported revenue of $1,450,000 in its accrual basis income statement for the year ended June 30, 2015. Additional information was as follows:  Under the cash basis, Gregg should report revenue of

Under the cash basis, Gregg should report revenue of

A) $1,035,000.

B) $1,050,000.

C) $1,305,000.

D) $1,335,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: A reversing entry should never be made

Q66: A company receives interest on a $70,000,

Q67: Definitions.Provide clear, concise answers for the following.<br>1.

Q68: All liability accounts and stockholders' equity accounts

Q69: Unearned revenue on the books of one

Q71: Included in Allen Corp.'s balance sheet at

Q72: Panda Corporation paid cash of $60,000 on

Q73: Which of the following errors will cause

Q74: At December 31, 2014, Sue's Boutique had

Q75: Reversing entries are made at the end