Multiple Choice

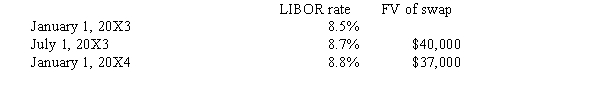

On January 1, 20X3, Shuey Company borrowed $1,000,000 at a variable rate based on LIBOR + 1.5% for 10 years with interest payable semi-annually. Shuey anticipates that interest rates will rise and has also arranged to receive a variable rate based on LIBOR + 1.5% in exchange for the payment of a 10% rate of interest. LIBOR rates were as follows on the reset dates:  How much interest expense is recognized for the six months ended December 31, 20X3?

How much interest expense is recognized for the six months ended December 31, 20X3?

A) $51,500

B) $50,000

C) $51,000

D) $51,200

Correct Answer:

Verified

Correct Answer:

Verified

Q6: An advantage of a fair value hedge

Q21: A forward contract<br>A)is not traded on an

Q26: On September 23, Gensil Company buys 40

Q28: On August 1, an oil producer decided

Q29: On July 1, 20X1, Littleton Inc. loaned

Q31: Which of the following has an asymmetric

Q44: At the beginning of 20X5, a derivative

Q53: A critical characteristic of a derivative is

Q54: Which of the following statements is true?<br>A)The

Q59: Based on the relationship between the strike