Multiple Choice

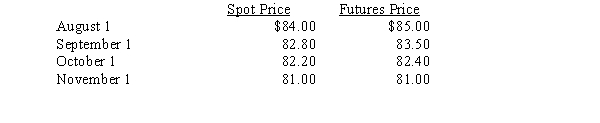

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What was the fair value of the contract on October 1?

What was the fair value of the contract on October 1?

A) $280,000

B) $110,000

C) $260,000

D) $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: A forward contract<br>A)is not traded on an

Q23: On August 9, Jacobs Company buys 25

Q25: Jenson Company buys 20 contracts on the

Q26: On September 23, Gensil Company buys 40

Q26: The underlying amount of a derivative instrument

Q29: On July 1, 20X1, Littleton Inc. loaned

Q31: On January 1, 20X3, Shuey Company borrowed

Q44: At the beginning of 20X5, a derivative

Q53: A critical characteristic of a derivative is

Q59: Based on the relationship between the strike