Essay

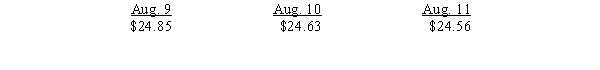

On August 9, Jacobs Company buys 25 contracts on Nymex to receive December delivery of Brent Crude Oil. Each contract is in units of 1,000 bbls at a futures price of $24.85 per bbl. The initial margin on the contract is set at $25,000, with a maintenance margin of $19,000. The futures prices are as follows:

Required:

a.Journalize the entries for Jacobs Company for the first three days of the contract.

b.Why are forward prices discounted and future prices are not discounted?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Forward contracts are contracts to buy or

Q18: With respect to derivative instruments that are

Q21: Jensen Company forecasts a need for 200,000

Q25: Jenson Company buys 20 contracts on the

Q26: The underlying amount of a derivative instrument

Q26: On September 23, Gensil Company buys 40

Q28: On August 1, an oil producer decided

Q34: In order for a fair value hedge

Q44: At the beginning of 20X5, a derivative

Q47: A swap<br>A)is not traded on an organized